Educational tax credits may be available to students or their parents/guardians for certain education related costs. IRS form 1098-T is used to report the amount paid for qualified tuition and fees. Unless students consent to receive their form electronically, it will be mailed to their official mailing address.

It is the taxpayer’s responsibility to determine the amount of qualified tuition and fees paid and to determine whether they are eligible for any tax credits. Students and parents can consult banking records, student statements, or the Student Account Center for all payment information.

What is a 1098-T?

The 1098-T form is an annual statement that reports the amount paid to UNCG for qualified tuition and related expenses for each student during the previous calendar year. The purpose of the form is to assist in determining eligibility for certain education-related tax credits (such as the Lifetime Learning Credit and the American Opportunity Credit) under the Taxpayer Relief Act of 1997.

The IRS requires eligible educational institutions such as UNCG to provide this statement to students and to the IRS. UNCG also must report this information directly to the IRS; therefore, the 1098-T is for information only and does not need to be attached to a tax return.

The 1098-T includes all payments and credits for qualifying tuition and fees. All charges are not considered qualified tuition and related expenses as defined by the IRS. UNCG First Day Complete charges are not included due to the ability for student’s to opt out of the program. Health Service fees and Transportation fees are not qualified; therefore the full amount of fees paid may not be reported.

The 1098-T form reflects account activity during the calendar year for the tax statement. For example, a 1098-T form sent in January 2026 includes payments made January-December 2025 to be reported on 2025 taxes.

It is possible you may find that the number reported in Box 1 may not be an exact match to your own payment records. Generally, this can be explained by the fact that payments are only reported up to the total amount of qualified tuition and related expenses (QTRE) that were charged to the student account during the same calendar year that the payments were made. Since payments are reported up to the total QTRE amount posted for the year, any portion of QTRE not yet reported as paid in Box 1 may “roll-over” for possible reporting in subsequent tax-reporting years.

In this example, the student’s 1098-T may include payments for:

- Spring 2025 (if payments were made in January)

- Summer 2025

- Fall 2025

- Spring 2026 (if payments were made in December)

The statement may also include payments or credits for scholarships, course adjustments, or other charges that took place during the 2025 calendar year, even if the student was not enrolled during 2025.

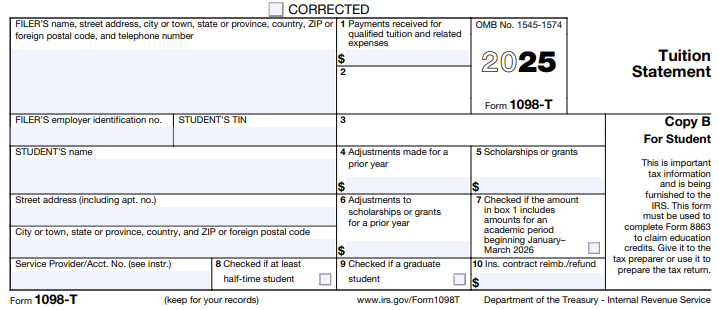

The 1098-T form includes several boxes as well as other informational fields. All boxes may not be filled in, depending on the student’s situation. Most students will see some or all of the following:

- Box 1: This represents the total payments from any source posted to the student account for qualified tuition and related expenses during the last calendar year, minus any reimbursements or refunds made during the same period that relate to payments received during the year before last. Please note the amount in Box 1 will not always equal to or sum to the charges paid for the calendar year.

- Box 4: Shows the amount of any adjustments made for a prior year for qualified tuition and related expenses or payments that were reported on a prior year 1098T form. This could reduce any allowable credit the student claimed for the prior year.

- Box 5: This box reports scholarship and grants, but not loans, posted to the student account during the calendar year.

- Box 6: Shows adjustments to scholarships or grants for a prior year. This may affect any allowable credit the student claimed in a prior year.

- Box 7: If this box is checked, then at least some amount of tuition paid is for the Spring semester of the next calendar year.

- Box 8: If this box is checked and the student is an undergraduate, it indicates the student was enrolled at least half-time for at least one semester during the tax year.

- Box 9: If this box is checked, then the student was a graduate student at any time during the tax year.

The 1098-T will be issued to all domestic UNCG students enrolled in academic classes who made payments, received credits or received financial aid during the tax year. Students who had adjustments to prior year tuition and fee payments, charges, or scholarship awards during the tax year may also be sent the 1098-T even if they were not enrolled during that period of time.

Students must complete the W-9S Substitute Form and provide it to the Cashiers and Student Accounts Office. Instructions for completing and uploading the form are contained at the top of the W-9S Substitute Form.

There are several reasons why a student may not receive a 1098-T:

- The student may have attended the prior Spring semester, but paid for tuition in the year before that. (In this case, the payment would have been included in the 1098-T form issued last year.)

- The student did not have any payments for qualified educational expenses within the tax year; therefore, a 1098-T form was not generated.

- The 1098-T was mailed to the student’s permanent address that is active on UNCGenie. If the student does not have an active mailing address in UNCGenie, a form will not be generated for them.

How to view the 1098-T

The 1098-T will be sent electronically or via mail, depending on the student’s preference. The form is sent no later than January 31 following the tax year to be reported.

Students who wish to receive their form via mail should make sure their permanent address is up-to-date in UNCGenie by January 1 of each year. If there is no official mailing address on file, a 1098-T form will not be mailed.

Students who wish to access their 1098-T form electronically on the Student Account Center must submit a request to consent for electronic delivery by December 31.

Currently and recently enrolled students:

- Log into UNCGenie with your UNCG iSpartan username and password.

- Select the Student Main Menu option.

- Under Student Services, select the Student Accounts tab and click on Student Account Center.

- In the Student Account Center, select “My Account”, select “Consents and Agreements”, read the consent form, and click “Accept Consent” to agree to receive the statement through online delivery.

Former students:

- Log in to the Student Account Center with your 9-digit Student ID number and 6-digit PIN at: go.uncg.edu/studentaccount-authorizedusers.

Students may also give their Authorized User(s) permission to view the Electronic 1098-T:

- In the Student Account Center, select “My Account” and “Authorized Users”

- Click the Action Button for an already established Authorized User (or first add a new Authorized User)

- Select “Yes” for “Would you like to allow this person to view your 1098-T tax statement?”

Authorized users can access the 1098-T form in the Student Account Center with their username and password.

- Log into UNCGenie with your UNCG iSpartan username and password.

- Click on Student Main Menu.

- Under Student Services, select the Student Accounts tab.

- Click on Tax Notification (1098-T)

- Click on Select Tax Year

- Enter the appropriate tax year and click Submit

To view, print, and download your 1098-T Tuition Statement in PDF format online:

Currently and recently enrolled students:

- Log into UNCGenie with your UNCG iSpartan username and password

- Click on Student Main Menu

- Under Student Services, select the Student Accounts tab

- Click on Student Account Center

- Click the My Accounts menu option in the Student Account Center

- Select Statements from the drop-down list

- Click on the 1098-T Tax Statements tab

- In the “1098-T Tax Statement” box, click “View” next to the appropriate Tax Year

Former students who no longer have an active iSPARTAN account:

- Log in to the Student Account Center with your 9-digit Student ID number and 6-digit PIN at: go.uncg.edu/studentaccount-authorizedusers.

IRS resources

Questions about how to compute educational tax credits should be directed to a tax professional or referred to the IRS. UNCG cannot provide tax advice or taxpayer assistance. The following links may be helpful for finding further information on 1098-T forms and tax credits:

CONTACT US

CASHIERS & STUDENT ACCOUNTS OFFICE

- Cashier window hours: Monday-Friday, 9 a.m.-4 p.m.

- Student accounts hours: Monday-Friday, 8 a.m.-5 p.m.

- Phone: 336.334.5831

- Fax: 336.334.4178

- Email: cashier@uncg.edu

- Mailing Address: PO Box 26170, Greensboro, NC 27402-6170

- Campus Address: 151 Mossman Building*

- *Face-to-face meeting with counselors by appointment only. Drop-Ins welcome for payments.

*How to make an appointment in Starfish